A study on the mobile app market in India and Southeast Asia (INSEA) by Adjust has shown that Indian consumers especially have a solid sense of loyalty to home headquartered apps, leading to an increased share of volumes across verticals like fintech, gaming, shopping, and entertainment.

The INSEA’s Mobile App Landscape Report prepared by the mobile marketing analytics company, Adjust, in collaboration with Sensor Tower, a digital & mobile intelligence provider, shows that rising digital infrastructure across INSEA has led to a surge in demand for apps that cater to local needs.

A big reason for this is the COVID-19 pandemic and the ease of access that smartphones provide for businesses to access their consumers. Developers have taken advantage of this chance and made apps that work well for these markets.

Ajit Pawar, Director of Partnerships for APAC at Adjust, says, “Alongside the business challenges it inevitably manifested, the pandemic and a few globally impactful crises since have brought about an unprecedented acceleration of mobile app growth in the INSEA region.”

“As a picture of the post-COVID app market has begun to take form, India and Southeast Asia have demonstrated impressive adaptability and endurance. Subsequently, 2023 promises to set the stage for new app growth and opportunities for development,” observes Ajit.

Here are the key trends mentioned in the report by Adjust, across fintech, shopping, entertainment, and gaming apps in INSEA.

Top Mobile Adoption - Fintech Apps

Southeast Asia is one of the top regions for digital mobile adoption in the fintech/mobile finance sector.

Of the fintech apps analyzed by Adjust, a significant percentage of downloads within each country were attributed to apps headquartered within that market, showing that users have an affinity for home-headquartered brands.

India, in particular, saw the highest headquarter contribution at 39% of total downloads in 2022, followed closely by Vietnam at 36%. These numbers demonstrate ample opportunity for export apps in the fintech sector to make inroads in the INSEA market.

Nan Lu, Director of APAC Marketing for Adjust, says, “Since 2017, India has surpassed the United States in app installs. Nowadays, combined with Southeast Asia, the two largest emerging mobile markets generated 32% of global app installs in 2022. This region is home to local tech leaders like PhonePe, JioCinema, Garena, and DANA, and is also crucial for many global giants to expand their reach and achieve further growth.”

Despite global economic uncertainty in 2022 and a downturn in the stock market, average fintech app downloads grew in INSEA YoY between 2021 and 2022. India’s fintech app downloads grew a sizable 32% in 2022, followed by Vietnam at 15% and Indonesia at 10%. Thailand and Singapore did, unfortunately, decline, at 11% and 2%, respectively.

Most Promising Sector - Mobile Gaming

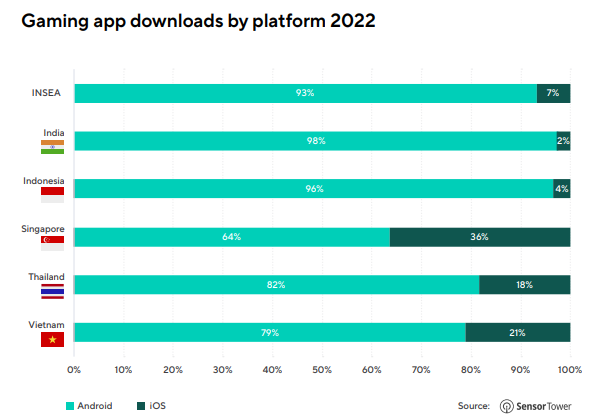

Mobile gaming is one of the most promising markets in India and Southeast Asia (SEA). In 2022, Google showed that almost 80% of the population plays mobile games, and one in three smartphone owners plays such games at least once a week.

Games like puzzles and sports tend to keep a 27% D1 retention rate in INSEA. Experts expect that in 2023, India will have 209.6 million gamers, making it profitable for companies exporting games.

According to the report, India has the highest number of game market downloads in the world. In Q1 2023, India game downloads were up 13% YoY to more than 2.5 billion. This was over triple the second-largest market, Indonesia, at 8.4 million downloads during the quarter.

Most Sticky Segment - Shopping Apps

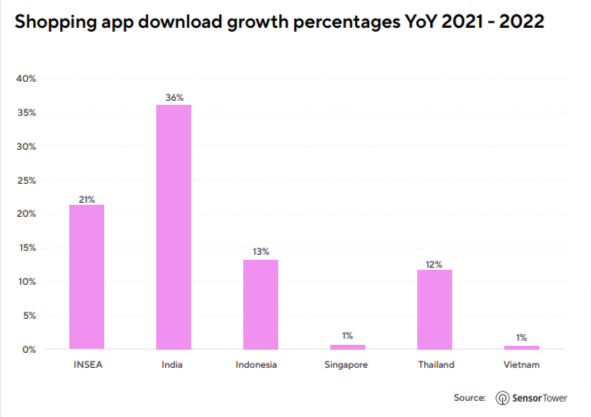

The pandemic led e-shoppers to have no choice but to turn to online shopping when stores closed. This triggered a permanent shift in the commerce market, marking a cultural shopping transition from brick-and-mortar stores to e-commerce apps.

Shopping apps headquartered in each country across INSEA saw a lot of downloads within those markets. This was especially true for India. Apps made in India made up almost a third (29%) of shopping app downloads in India in 2022.

According to the report, India’s shopping app installs grew dramatically compared to the global average when looking at 2022 vs. 2021— while global installs were up 2%, India skyrocketed 43%. Shopping apps in SEA used to see 47.8 minutes per session on average, whereas the global average session length is only around 11.1 minutes.

Most Localised Apps - Entertainment Sector

Many entertainment apps, like Netflix and Disney+, are popular in the INSEA region. Yet, individual countries within this region made apps that developed content based on the country’s respective native languages.

Apps like iflix, HOOQ, Viu, and Catchplay are fast becoming major sources of information and entertainment.

In terms of home-headquartered contribution, India loves using apps made within the country more than any other nation in INSEA. In 2022, 27% of Indian entertainment app downloads were from Indian apps. Vietnam came next, with 15% of its downloads stemming from home and Indonesia with 11%.

What we understand

For this report, Adjust analyzed the top 5,000 apps in its platform from January 2021 – January 2023 and looked at data for fintech, shopping, entertainment, and gaming apps, including several game sub-verticals.

According to the report, despite some dips and climbs, overall, 2023 promises to bring a number of opportunities for apps across India and Southeast Asia. Indeed, the mobile app market in INSEA is expected to experience significant growth over the next few years.

The data suggests that home headquartered apps make up a large portion of the INSEA region. India especially demonstrated a particularly strong sense of loyalty to home headquartered apps.

The report also concludes that although INSEA’s stickiness and retention rates were below average after installation, app developers have good potential to keep users engaged and returning during the first month. Overall, if app marketers can get users to keep using the app for longer after installing it in the INSEA region, it would greatly boost their revenue.

You can read the detailed report here.