Gunjali Kothari, alongside her co-founder Manoj Gupta, is orchestrating one of the most audacious plays that I’ve seen in Indian fintech. Their company, Flashaid, is pioneering a new market category entirely: an insurance-backed, loan-free EMI platform designed to solve one of India’s most persistent and painful problems – student loans.

In simple terms, Flashaid has created a new way for students and parents to pay for education. Instead of forcing them to pay a large lump-sum fee upfront or take out a high-interest loan, Flashaid allows them to pay in manageable, loan-free monthly installments (EMIs). The genius of the model lies in its security layer. The EMIs are backed by a custom-built insurance policy.

If a family faces a genuine crisis, such as a job loss or a medical emergency, the insurance kicks in to cover the remaining fees. This elegantly solves the problem for both sides. Students avoid debt and the stress of credit checks, while educational institutions secure their revenue and significantly reduce student dropouts.

Backed by over $7 million in funding from investors like Venture Catalysts, Flashaid’s traction is a testament to the resonance of its idea. According to Gunjali, the company partners with over 200 educational institutions, from universities to upskilling platforms like Edureka. Through these partnerships, Flashaid processes over 1,000 new fee-protection policies every month (growing at 30% MoM), and they are on a $2 million annual revenue run-rate.

But the numbers, as impressive as they are, don’t tell the whole story. The real innovation is Gunjali’s contrarian thesis that the best way to solve India’s massive education financing gap isn’t with more lending, but with less.

In a conversation with ProdWrks, Gunjali explains how Flashaid replaces the anxiety of debt with the security of insurance, using technology as an enabler to their innovative business model.

An Entrepreneur at Age 14!

At the age of just 14, while most of her peers were navigating the pressures of high school, Gunjali founded her first venture, an educational institute.

“Getting the first customers, getting the registration done for the school, getting the teachers and convincing them… the entire journey was done hands-on, on the ground in a tier-two city. We started with that, and it's been more than 20 years now. It's still successfully running.”

This early venture (now managed by her aunt) was a foundational experience that embedded in her a deep understanding of problems plaguing India’s education system. This included parents struggling to pay fees on time, the awkward conversations, the requests for extensions, and the quiet desperation. It was a problem of cash flow.

Years later, after an MBA, a successful stint building a thousand-crore SME book at IDBI Bank, and a formative role at the fintech startup CredX, Gunjali returned to solve this core problem with Flashaid.

The Anatomy of a ₹9 Lakh Crore Gap in Indian Education

To understand the genius of Flashaid, one must first appreciate the scale of the problem it’s tackling. Gunjali shares that the Indian education market is a colossal, rapidly expanding beast, valued at over $180 billion (approx. ₹15 lakh crore). The higher education and upskilling segment alone, growing at a blistering 25% YoY, represents a massive opportunity.

Yet, the financial infrastructure supporting it is fundamentally broken.

“If you look at the macro numbers, less than 10% of education financing is covered by banks and traditional NBFCs. The rest is financed from the pocket of the parent. We estimate the gap is tremendous, almost like a nine lakh crore gap,” Gunjali explains.

This gap creates a two-sided crisis.

On one side are the students and their families. For them, the path to financing education is a gauntlet of rejection. They may lack the pristine CIBIL scores that traditional lenders demand. Their parents might be self-employed business owners in Kochi or farmers in rural Punjab, with income streams that don’t fit neatly into a bank’s underwriting model. Also, for many Indian parents, a loan is a “stigma” and a heavy burden they are reluctant to bear.

“Every day we had to deal with the problems of, ‘Can I pay you next month? Can I pay you in EMIs?’” Gunjali says, recalling her days running the institute. “The problem in India is not of affordability. It's actually a timing problem. They just want to pay in small, small EMIs.”

“Institutes were losing 15 to 30% of their revenue at the fee payment stage itself,” Gunjali reveals. This lost revenue cripples their ability to invest in faculty, infrastructure, and growth.

“Many institutes have come up and told us that we do not want a lot of harassment to be done to the students. This entire model has to work around security and protection rather than collection,” says Gunjali.

This was the complex, deeply human, and financially massive problem space that Gunjali and her co-founder, Manoj Gupta (whom she met at CredX) decided to tackle.

But their path to the classroom began, unexpectedly, in a hospital.

The Pivot: From Hospital Corridors to University Campuses

Before founding Flashaid, Gunjali started Easy Aspataal. Launched during the peak of the COVID-19 pandemic, Easy As initial thesis was focused on healthcare. The idea behind Easy Aspataal was to provide reimbursement financing for patients who had to pay out-of-pocket for hospital expenses.

They visited 200 hospitals on foot during the peak of the COVID-19 pandemic. The experience was a brutal but invaluable lesson in on-the-ground execution. They onboarded hospitals and even raised a seed round of ₹4 crore from Venture Catalysts. But they soon ran into a fundamental market truth.

“We understood that pocket-friendly health insurance has to be contextualized. In India, there are so many insurance products, but the adoption is still less than 5-6% because it is not contextualized. It's very important to attach the product and embed it,” says Gunjali.

Selling standalone insurance was a “high-friction, high-CAC” game. The unit economics were challenging. This insight was pivotal. The problem wasn’t the product (insurance), but it was the delivery mechanism. Insurance, they realized, wasn’t a product to be sold, but a feature to be embedded. It’s a powerful risk-mitigating layer that could unlock other services.

Their minds went back to problems in the education sector that Gunjali knew so intimately. What if they could use insurance not to cover a catastrophic health event, but to de-risk the inability of students or parents to pay a fee on time due to a temporary crisis like a job loss, an accident, or a medical emergency?

“We understood that this protection of insurance can really solve a very big, massive problem in the industry. That is what we started building,” states Gunjali

With this new clarity, they raised a Pre-Series A round and Flashaid, as it exists today, was born as a pivot from Easy Aspitaal.

The Contrarian Bet: Building EMI without Loans

“We've actually built a loan-free, insurance-backed EMI system. I think that's the biggest bet anyone could have taken,” says Gunjali with a note of pride in her voice.

Here’s how the “Smart Fee” system works in Flashaid.

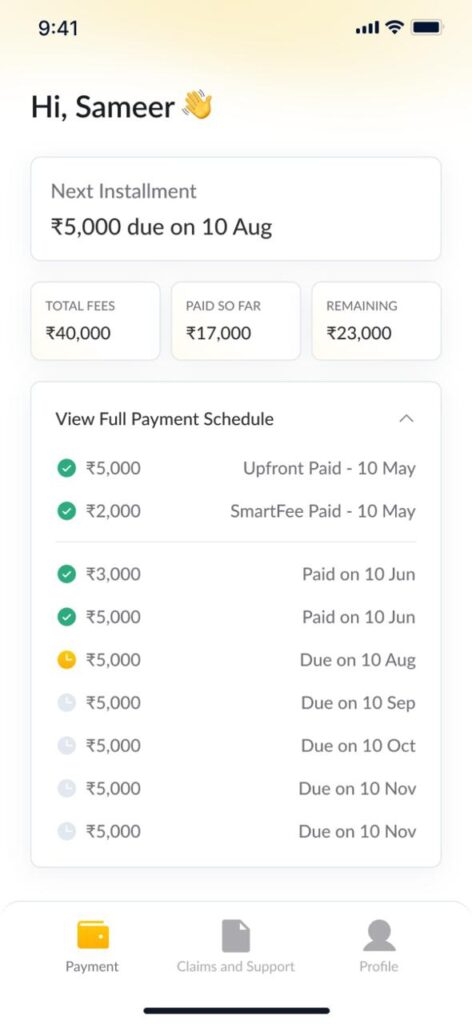

Instead of offering a loan to the student, Flashaid partners with the educational institution. When a student needs to pay their fees in installments, they are onboarded onto the Flashaid platform. This is a quick, two-minute process requiring minimal documentation (PAN, Aadhaar, bank details) to set up a NACH mandate* for recurring payments.

*A NACH mandate is a digital payment facility offered by the National Payments Corporation of India (NPCI). It automates recurring payments like loan EMIs, insurance premiums, and utility bills, enabling users to authorize automatic debits from their bank accounts. This process is facilitated through a one-time digital authorization, eliminating the need for manual payments and ensuring timely transactions.

The crucial difference is what happens under the hood. For a small fee (typically 5-7% of the fee amount, often borne by the student or subsidized by the institute), Flashaid embeds a comprehensive insurance policy.

But, this isn’t just a simple life insurance cover. It’s a bundled product, created in partnership with five leading insurance companies, that covers a range of genuine default scenarios: job loss, accidental death, temporary or permanent disability, and critical health emergencies.

The result is a win-win for students, parents, and Flashaid:

1. For the Student: They get a zero-cost, loan-free EMI facility without any credit checks or complex paperwork. More importantly, they get peace of mind. If a genuine crisis strikes, their fees are covered, and their education isn’t derailed. Their credit history isn’t damaged, and their family isn’t hounded by collection agents.

2. For the Institution: They get seamless, automated fee collection and drastically reduced revenue leakage. They can now admit students who would have otherwise dropped out due to a lack of financing options, instantly increasing their admission volume by up to 30%. The risk of default is transferred from their books to an insured, structured system.

3. For Flashaid: They have created a highly scalable, low-risk business model. Their revenue comes from the platform and smart fee charges, which fund the insurance premiums and their operations.

Gunjali says, “We are providing students an EMI solution, loan-free, backed by insurance protection. This is a very unique use case where, with the help of insurance protection and security in the backend, you can provide that EMI financing.”

A Product-Led, AI-Infused Approach

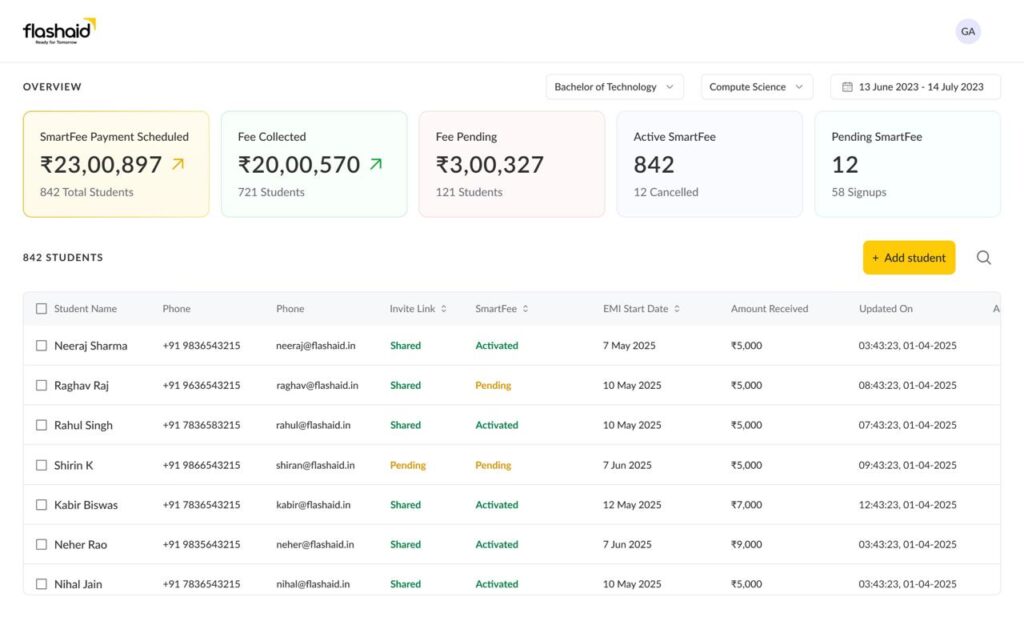

Flashaid is a product-first company, obsessed with reducing friction and automating processes. The institutional side of the platform is a clean, intuitive dashboard. After an initial underwriting process where Flashaid uses its proprietary “Flashaid Smart Fee Score” to assess the institution’s viability, the partner is onboarded.

“We have different criteria and parameters for the institute. ‘How old is it? What is the course duration? Are the courses relevant to the market? What is the founder's background? What's dropout rate? All of this put together generates a quick score and that helps us underwrite this institute better,” Gunjali explains.

Once onboarded, institutes can set up their courses, define fee structures (including upfront payments, which Flashaid provides for free to incentivize better collections), and add students in bulk. The dashboard gives them a real-time, bird’s-eye view of their collections (total fees collected, pending payments, and mandate success rates.)

For the student, the experience is designed to be “as frictionless as UPI.” The entire onboarding, from receiving a link to setting up the NACH mandate, is tracked meticulously.

Gunjali says, “It takes two minutes for my user right now. We are tracking it to the core, and we're trying to reduce the steps to bring it down to 30 seconds. That will be a game-changer.”

This obsession with efficiency is powered by a lean, in-house tech team and a savvy adoption of AI and automation tools.

“We have automated the entire flow from where the lead generates to where the servicing happens,” she says, mentioning tools like SendPulse and Make.com for their notification and IVR journeys. But their use of AI goes deeper. They have an “AI Champion” in the team whose sole job is to explore and implement new AI tools across departments to boost efficiency.

“We've seen that a lot of our workload has been reduced. I would say 20% of my workload has reduced. We were earlier planning to have three or four members just to handle the operations process. Now we do not really need to hire.”

GTM Strategy to Reduce Partner Onboarding from 9 Months to 7 Days

“It was taking nine to ten months for the closure of a university,” Gunjali admits. “They are very cash-rich. They do not want to part with funds, and they do not want to take the liability of a student. We realized this is not going to work.”

“Now, when we have the conversation about the ‘Flashaid Smart Fee’ with the backed-by-insurance EMI facility, we see universities getting converted within seven days. That is game-changing. It's about how you execute, and you got to listen to your customers and focus on their problem first, rather than your solution always.”

“Every month, we are doing around 1,000 policies, and we're seeing it increasing 30% month-on-month,” she reports.

The Future of Fintech - Tokenized, Global, and Underwritten by AI

Four years in, Flashaid is just getting started. Gunjali Kothari’s vision extends far beyond the current landscape. She sees a future where education financing is as instant, secure, and inclusive as UPI, not just in India, but across the globe.

“Our core vision is that we have to make education accessible,” she affirms. The immediate roadmap includes expanding into the lucrative “study abroad” market and enabling cross-border fee payments. But the technological horizon is even more exciting.

Gunjali is heavily bullish on three key areas:

1. AI-Powered Underwriting with Alternate Data: The next frontier is to move beyond underwriting the institution and develop a sophisticated model for underwriting the student’s intent and future potential.

She says, “We are talking about the student’s entire behavior, where they are spending, and their digital footprint. This kind of alternate data is going to help us approve more and more students.”

2. Smart Contracts and Tokenization: To make the claims process even faster and more transparent, Flashaid is exploring blockchain-based smart contracts.

“We can develop smart contracts, some sort of tokenization, which can be done so that the insurance payment also happens faster to these students,” Gunjali adds.

3. Wallet-as-a-Platform: The long-term vision is to create a comprehensive financial ecosystem for students, where insurance, rewards, and banking services are all bundled into a single, seamless platform.

From a 14-year-old setting up a school in Lucknow to a fintech founder rewiring a multi-billion dollar industry, Gunjali Kothari’s journey has come full circle. She started by identifying a fundamental need and is now solving it at a scale she couldn’t have imagined then.

Flashaid’s story is a powerful reminder for every product leader and founder about the power of first-principles thinking, the courage to take a contrarian path, and the profound impact that comes from solving a real, human problem.

By de-risking education, they are not just securing fees or building a business. They are securing the future of millions of students and building a safety net for a million dreams.